Financial Solutions

Solutions for Financial

In the retail and financial services sectors, one of the top applications of M2M is ATM (automated teller machine) networking. The application can create impressive new revenue by enabling companies to put machines where they might otherwise not have reached.

Since the going rate for an ATM these days is in the $150,000 range, it only makes sense for banks to move these very expensive machines to the areas where demand for quick cash is highest. However, wireline connections are not always available where the action is, be it a where a major sports event is being played, a major concert is being staged, or to a popular shopping mall during the holiday season.

Facilitating a portable ATM relies on a wireless router inside of the ATM sending digital data to the banks central computer over a public wireless wide-area network rather than a leased line. When this M2M solution is properly executed, transactional security is commensurate to what a security officer would like to see in a wired environment.

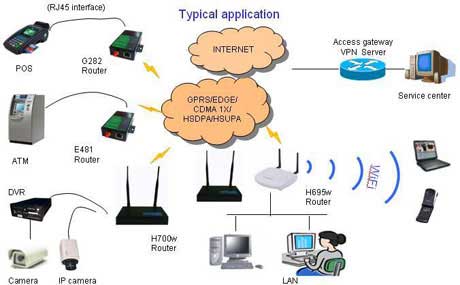

Typical Solution Diagram

As 3G public networks continue to be rolled out across the country, banks will begin to use wireless data communications as their primary means of ATM connectivity, replacing the leased lines in place today. And there are other exciting developments coming down the pipe. With the greater bandwidth afforded by 3G, additional options for portable ATMs in development include the addition of location tracking capabilities for stolen or lost ATMs, and video capabilities to record attempted robberies. Sometimes ATMs are not meant to be mobile, and the addition of a GPS receiver is a security feature that should be considered for every cash point machine.